Latest Search

Quote

| Back Zoom + Zoom - | |

|

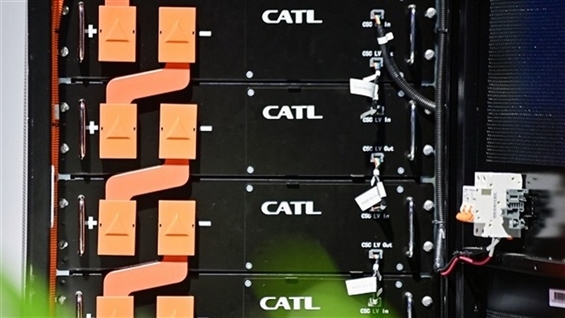

<Research>Citi: CATL (300750.SZ) Remains Top Pick as 3Q Results in Line

Recommend 3 Positive 4 Negative 6 |

|

|

|

|

CATL (300750.SZ)'s 1-3Q25 net profit was RMB49 billion, up 36.2% YoY, while core net profit amounted to RMB43.6 billion, up 35.6% YoY, Citi Research issued a research report saying. The net profit for 1-3Q25 reached 69%/ 73% of the full-year estimations of Citi Research/ market. CATL reported a net profit of RMB18.5 billion for 3Q25, up 41.2% YoY and 12.3% QoQ. The Company's calculated core net profit stood at RMB18.5 billion, up 7.5% YoY and 23.3% QoQ. Both net profit and battery sales volume for 3Q25 were in line with the broker's expectations. Citi Research believed that the supply and demand in the battery industrial chain are rebalancing, with the booming demand for energy storage systems marking the beginning of a new cycle. Therefore, CATL remains the broker's top pick, along with EVE ENERGY (300014.SZ), CALB (03931.HK) and HUNAN YUNENG (301358.SZ). AASTOCKS Financial News Website: www.aastocks.com |

|